Pension Administration Strategy 2019-22

INTRODUCTION

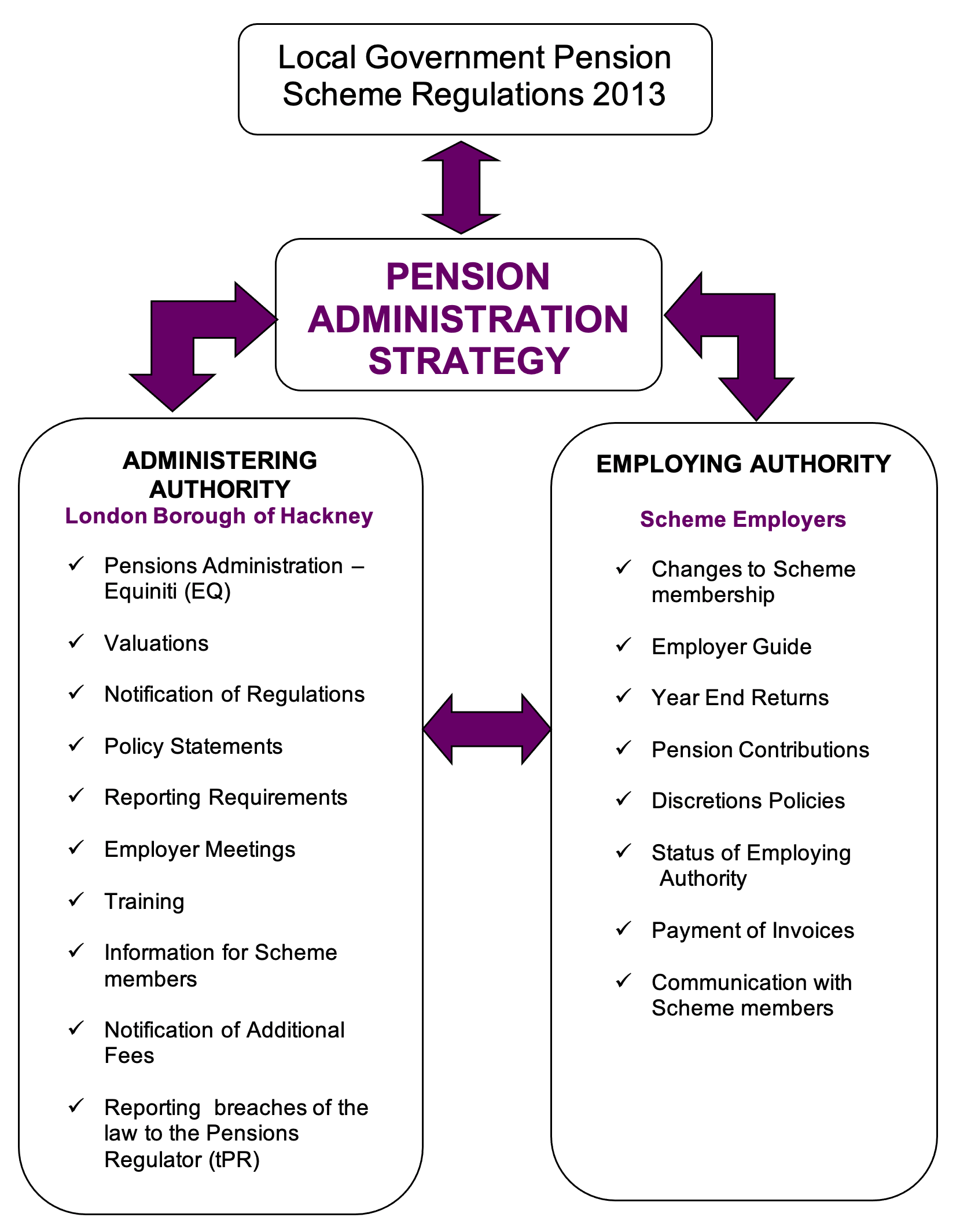

This is the Administration Strategy Statement of the London Borough of Hackney Pension Fund (the Fund) in relation to the Local Government Pension Scheme (LGPS – the Scheme), which is administered by the London Borough of Hackney (LBH) and Equiniti (EQ). Below is a diagram showing the roles and responsibilities of the parties in the administration of the scheme

Aims and Objectives

The aim of this Pension Administration Strategy is to set out the quality and performance standards expected of the Fund and its scheme employers. The Administration Strategy will assist in clarifying the roles and responsibilities of both the Administering Authority and the Employing Authorities, i.e. those employers who participate in the Pension Fund.

In addition, there are approximately 70 local authority schools that operationally are part of the London Borough of Hackney, but use separate payroll providers. Unless specifically mentioned otherwise, all references in this strategy to employers apply to these local authority schools, and they are required to provide information as if they are separate employers.

Effective and efficient administration of the pension fund is beneficial to all stakeholders in the Pension Fund, the Administering Authority, employers and scheme members. The following are some of the benefits to be had from having efficient pension scheme administration; the list is by no means exhaustive and is not in order of importance.

For the Administering Authority, effective administration means:

- It can fulfil its obligations under the regulations for administering the pension scheme

- Lower costs, improved use of resources

- Easier and swifter provision of services to employers and scheme members

- Improved communication between Administering Authority, employers and scheme members

- Improved monitoring of performance

- Clean data enabling faster and more accurate monitoring of the Pension Fund by the Fund actuaries

- Improved decision making in relation to policies and investments

For Employing Authorities, effective administration means:

- Greater understanding of the Pension Fund and its impact upon them as an employer

- Lower costs

- Improved communication

- Employee satisfaction

- Improved decision making for budgeting

- Fulfilling its obligations as an Employing Authority under the LGPS regulations

For Scheme members, efficient administration means:

- Accurate records of their pension benefits

- Earlier issuance of annual benefit statements

- Faster responses to their pension record queries

- Faster access to benefits at retirement

- Improved communications

- Enhanced understanding of the pension scheme and the benefits of being a member

Setting out the expectations of the Administering Authority and Employing Authorities will help to ensure that both parties are aware of their roles and responsibilities in relation to the administration of the pension scheme. Both employer and administrator are dependent on the other for effectual communication and accurate flows of information without which the pension scheme cannot be administered effectively. The scheme members are reliant on both the employer and the administrator to ensure that their pension records are accurate and that they are well informed.

The Pension Administration Strategy is not meant to supersede existing procedures or policies but to complement them. The Admission Agreement sets out some basic requirements of both the Administering Authority and the employer and the Employer Guide sets out in detail how to carry out day to day administration of the Pension Fund within the employer’s site.

The Pensions Administration Strategy has a number of specific objectives, including:

- Deliver an efficient, quality and value for money service to its scheme employers and scheme members

- Ensure payment of accurate benefits and collect the correct contributions from the right people in a timely manner

- Ensure the Fund’s employers are aware of and understand their role and responsibilities under the LGPS regulations and in the delivery of the administration function

- Maintain accurate records and communicate all information and data accurately, and in a timely and secure manner

- Set out clear roles and responsibilities for the Council and Equiniti and work together to provide a seamless service to Scheme employers and scheme members

- Continuously review and improve the service provided.

Implementation

The Administration Strategy is effective from 1 April 2020.

Regulatory basis

The Scheme is a statutory scheme, established by an Act of Parliament. The following regulations governing the Scheme are shown below:

- Local Government Pension Scheme (Benefits, Membership and Contributions) Regulations 2007 (as amended)

- Local Government Pension Scheme (Administration) Regulations 2008 (as amended)

- Local Government Pension Scheme (Transitional Provisions) Regulations 2008 (as amended)

- Local Government Pension Scheme Regulations 2013 (as amended)

- Local Government Pension Scheme (Transitional Provisions and Savings) Regulations 2013 (as amended)

Regulation 59(1) of the Local Government Pension Scheme Regulations 2013 enables a Local Government Pension Scheme Fund to prepare a written statement of the authority’s policies ("its pension administration strategy") as one of the tools which can help in delivering a high quality administration service to its scheme members and other interested parties.

In addition, Regulation 59(2)e of the 2013 regulations allows a fund to recover additional costs from a scheme employer where, in its opinion, they are directly related to the poor performance of that scheme employer. Where this situation arises the fund is required to give written notice to the scheme employer, setting out the reasons for believing that additional costs should be recovered, the amount of the additional costs, together with the basis on which the additional amount has been calculated.

ADMINISTRATION IN THE LONDON BOROUGH OF HACKNEY

Responsibility

The London Borough of Hackney has delegated responsibility for the management of the Pension Fund to the Pension Committee. The Pension Committee will monitor the implementation of this Administration Strategy on an annual basis.

In addition the Pensions Board will assist and advise the Administering Authority in ensuring compliance with the Regulations and will receive reports on the Administration Strategy and its effectiveness.

Objective

The Fund’s objective in relation to administration is to deliver an efficient, quality and value for money service to its scheme employers and scheme members. Operationally the administration of the Fund is partly outsourced to Equiniti and partly carried out by staff of the Administering Authority.

The Administering Authority and Equiniti staff work together to provide a seamless service to scheme employers and scheme members.

Communications

The Fund has published a Communication Strategy Statement, which describes the way the Fund communicates with:-

- scheme members

- members representatives

- prospective members

- scheme employers

- other stakeholders/interested parties

The latest version of the Communication Strategy Statement can be obtained from the Fund website:- www.hackneypension.co.uk

The table below summarises the current methods the Fund uses to communicate:

| Method of Communication | Communication material |

| Website www.hackneypension.co.uk | Information about the Fund, the LGPS, administrative procedures, policies and forms for use |

| Newsletters | Annual newsletter and additional newsletters issued as may be necessary to highlight new issues and forthcoming events |

| Employer meetings | Held annually to provide Employers with a forum to address the Fund’s staff and advisers |

| Pensions helplines:- Equiniti Administering Authority (LB Hackney) Pension Team |

01293 603 085 020 8356 2521 |

| E-mail addresses: For the Equiniti team: Hackney.pensions@equiniti.com For the Administering Authority team: pensions@hackney.gov.uk |

To answer day to day questions about administering the Scheme |

| Individual Employer meetings | Offered to Employers who need advice about how to carry out the day to day administration of the Scheme |

| Annual Benefit Statements | Sent to active and deferred scheme members |

| Individual Scheme member meetings | 1-2-1 meetings available with a member of the Pensions team as required |

| Pension Presentations | Presentations to staff, managers, new employees, etc. on pension related matters |

Training and Engagement

The objectives of the Fund have always been to keep stakeholders informed of new developments by sending emails and newsletters, and by providing free training, forums and workshops for Employers when new Regulations are implemented or are under consideration. Additionally free training is offered on an ongoing basis to new scheme employers or relevant new HR/Payroll staff.

It is important that Employers ensure that their staff have the right level of skills and knowledge to support any changes, starting with a sound foundation of existing regulations and administrative processes. There is an ongoing need to continuously maintain the quality of member records and the administrative processes by improving the quality of information received from Employers.

The aims of this approach are therefore:-

- To maintain a high standard of customer service for members and Employers

- To ensure that relevant staff within each Employer have sufficient knowledge and skills to effectively discharge administrative processes

- To ensure that Employers are fully aware of the risks involved in poor administration and maintenance of member pension records and if they fail to discharge of their discretionary functions

- To provide ongoing training on relevant employer responsibilities

- To support the implementation of new technology within the Fund to enable self-service for the Employer and streamlined administration

To achieve this, the Fund will:-

- Work with Employers’ Human Resources, Payroll and other staff to help develop relevant skills and knowledge by providing appropriate assistance, guidance and training

- Organise free workshops and forums for Employers to debate new issues as they emerge

This strategy will ensure that Employers have a common understanding of their obligations under the Local Government Pension Scheme, and that administrative processes are designed to maximise efficiency and effectively manage risk.

The Fund will provide free training for Employers’ relevant staff, to build up and maintain a level of professional expertise which will enable Employers to deliver information required by the Fund to efficiently administer the Scheme.

PERFORMANCE STANDARDS

The Scheme prescribes that certain decisions be taken by either the Fund or the scheme employer, in relation to the rights and entitlements of individual scheme members. In order to meet these obligations in a timely and accurate manner, and also to comply with overriding disclosure requirements, the Fund has agreed levels of performance between itself and scheme employers which are set out below:

Overriding legislation

Scheme employers will, as a minimum, comply with overriding legislation, including:

- Local Government Pension Scheme Regulations

- Pensions Acts 2004 & 2011 and associated disclosure legislation

- Public Service Pensions Act 2013 and associated record keeping legislation

- Freedom of Information Act 2000

- Equality Act 2010

- Data Protection Act 2003/GDRP legislation effective from 25 May 2018

- Finance Act 2013

- Relevant Health and Safety legislation

- Any other legislation that may apply at the current time

Internal quality standards

The Fund and scheme employers will ensure that all functions and tasks are carried out to agreed quality standards. In this respect the standards to be met are:

- compliance with all requirements set out in the Employers’ Guide

- all information required by the Fund to be provided in the required format and/or on the appropriate forms referred to in the Employers’ Guide which are accessible from the Fund website at www.hackneypension.co.uk

- information to be legible and accurate

- communications to be in a plain language style

- information provided to be checked for accuracy by an appropriately qualified member of staff

- information provided to be authorised by an appropriate officer

- actions are carried out, or information provided, within the timescales set out in this Administration Strategy.

Timeliness

Overriding legislation dictates minimum standards that pension schemes should meet in providing certain pieces of information to the various parties associated with the Scheme. The Scheme itself sets out a number of requirements for the Fund and scheme employers to provide information to each other, scheme members and prospective scheme members, dependants, other pension arrangements or other regulatory bodies. The following sections on responsibilities set out the locally agreed timescales for these requirements.

FUND RESPONSIBILITIES

The London Borough of Hackney is the Administering Authority of the London Borough of Hackney Pension Fund and has delegated powers to the Pensions Committee to oversee the management of the Pension Fund. The role of the Administering Authority is to administer the Pension Fund and act as a quasi-trustee body for the management of the Pension Fund.

The Pensions Board comprising equal numbers of employer and scheme member representatives will assist the Administering Authority in ensuring compliance with the regulations and in particular as this affects the administration of the Pension Fund and will therefore review the effectiveness of the Fund’s Pension Administration Strategy on an annual basis.

This section outlines the key responsibilities of the Fund and the performance standards scheme employers and scheme members should expect. It is focussed on the key activities which scheme employers and scheme members are involved in and should not be viewed as a complete list of all activities. It includes the performance standards that the Administering Authority has agreed with the pension administrators, Equiniti (EQ).

Administering Authority Fund Administration

This section details the functions which relate to the whole Fund, rather than individual scheme members’ benefits.

| Task/Function | Standard |

| Pension Administration Strategy - PAS | Consult with employers following any significant revisions to the Administration Strategy Publish agreed Strategy within 2 months of being agreed by the Pensions Committee |

| Member Scheme Guide to the LGPSMember Scheme Guide to the LGPS | Update & publish within 30 working days from any significant revision. |

| Pension forms | Update & publish within 30 working days from any significant revision. |

| Scheme Employers’ meeting | Annually |

| Training sessions for scheme employers. | Upon request from scheme employers, or as required. |

| Changes to the scheme rules. | Notify employers within 2 months of the change(s) coming into effect. |

| Employer’s unsatisfactory performance. | As soon as a performance issue becomes apparent. |

| Recovery of additional administration costs - associated with the scheme employer’s unsatisfactory performance (including any interest that may be due). | Within 30 working days of scheme employer’s failure to improve performance, as agreed. |

| Annual Benefit Statements to active and deferred members | To be issued no later than 5 months after the end of the Scheme year to which it relates. |

| Valuation results (including individual employer details). | 10 working days from receipt of results from the Fund’s actuary (but in any event no later than 31 March following the valuation date). |

| Cessation valuation exercises – on cessation of admission agreements or a scheme employer ceasing participation in the Fund. | Upon each cessation or occasion where a scheme employer ceases participation on the Fund. |

| Arrange for calculation of FRS102 (valuations for employers as required) | Issue results within 10 working days from receipt from the Fund’s actuary |

| Admission Agreements for new scheme employers, where required (including the allocation of assets and notification to the Secretary of State). | Within 3 months of employer entry to the scheme |

| Governance Policy and Compliance Statement. | Publish within 30 working days of policy being agreed by the Pensions Committee. |

| Funding Strategy Statement – FSS reviewed at each triennial valuation, following consultation with scheme employers and the Fund’s actuary | Revised statement to be published at the same time as the final valuation report is issued. |

| Pension Fund Annual Report and Accounts – PF R&A (and any report from the auditor) | By 30 September following the year end or following the issue of the auditor’s opinion |

| Communications Strategy Statement. | Publish within 30 working days of policy being agreed by the Pensions Committee |

| Statement of Investment Principles - SIP | Publish within 30 working days of policy being agreed by the Pensions Committee |

| Administering Authority Discretions Policies | Publish within 30 working days of policy being agreed by the Pensions Committee |

| Statutory auto-enrolment communications Agree with integrated bodies (e.g. maintained & VA schools) the arrangements for each 3 year auto-enrolment cycle, and provide written confirmation of those arrangements. | No less than 6 weeks prior to the staging date |

SCHEME ADMINISTRATOR RESPONSIBILITIES

The Fund’s third party administrators, Equiniti (EQ), assist with the overall administration of the scheme and to ensure the smooth operation of the administrative function.

Equiniti can be contacted via their helpline number - 01293 603 085

or by email: – hackney.employers@equiniti.com

As a Fund, there are certain administrative functions that, under the LGPS Regulations, are legal requirements and must be processed within set timeframes. If scheme employers do not provide the requested data correctly, in the right format and within the timescales requested by the administrators, the Fund cannot meet its legal obligations and may be liable to penalty fines imposed by the Pension Regulator (tPR).

The administrators, and the Fund, are therefore reliant on employers providing the data in order to correctly administer the scheme and fulfil its legal duties as listed below:

| Process | Legal Requirement |

| To process new member information e.g. creating a pension account record | Provide information about the scheme within:

|

| To provide transfer value information | 3 months from date of request |

| To inform members who leave the scheme of their deferred benefit entitlement | As soon as is practicable, and no more than 2 months from date of initial notification (from employer or scheme member) |

| To notify the amount of retirement benefits and payment of tax free cash sum | 1 month from date of retirement if on or after Normal Pension Age 2 months from date of retirement if before Normal Pension Age |

| To notify dependant(s) of the amount of death benefits | As soon as possible but in any event no more than 2 months from date of becoming aware of the death, or from date of request |

| Provide annual benefit statements to active and deferred members | 31st August in the same calendar year |

Service Standards Agreement - SLAs

In order to meet the legal requirements of the LGPS, the Fund as implemented a number of operational Service Standards in relation to the administration services provided by Equiniti: -

- All Service Standards are quoted in working days unless otherwise indicated.

Note – these Service Standards are only achievable with the cooperation of all scheme employers and by providing the correct data & information when requested:

| Category | Process | Service Standard | ||||||||

| Retirements |

|

|

||||||||

| Death of a Member |

|

|

||||||||

| New Joiners main scheme & 50/50 scheme |

|

|

||||||||

| Estimates or Quotes |

|

|

||||||||

| Transfer In |

|

|

||||||||

| Transfer Out |

|

|

||||||||

| Pension Sharing Orders |

|

|

||||||||

| Retirements |

|

|

||||||||

| Leavers |

|

|

||||||||

| Leaver Refunds |

|

|

||||||||

| Additional Contributions & Benefits |

|

|

||||||||

| Annual Benefit Statements |

|

|

SCHEME EMPLOYER RESPONSIBILTIES

This section outlines the responsibilities of all scheme employers in the Fund and the performance standards scheme employers are expected to meet to enable the Fund to deliver an efficient, quality and value for money service.

External Payroll or Administration Providers

Scheme employers must ensure that appropriate record-keeping is maintained and where they outsource their payroll, HR or pension administration functions to a third party, the legal responsibility for the provision of pension data to the Administering Authority or the third party pension administrator, lies with the Scheme employer and not the third party. Third party provision of these services includes companies such as: HLT (Hackney Learning Trust), Capita, EPM, Strictly Education etc.

Any external service providers with responsibility for carrying out any functions relating to the administration of the Local Government Pension Scheme must be made are aware of the standards that are to be met.

Scheme employers must therefore ensure, as part of any contract entered into with a third party, that the third party has sufficiently robust processes in place to fulfil the statutory duties of the Scheme and the performance levels set out in the Pension Administration Strategy.

All information must be provided in the format prescribed by the Fund and within the prescribed timescales. Information and guidance is provided in the Employers’ Guide which is available from the funds web site www.hackneypension.co.uk

Employer Responsibilities

This section details the functions, some of which are statutory, and relate to scheme employers’ responsibilities and tasks:

| Task/Function | Performance Target |

Nominated Representative To receive information from the Fund and to take responsibility for disseminating it within the organisation. Ensure the Fund is kept up to date with any change to the nominated representative.

|

Notify the Fund within 30 working days of employer joining fund, or change to nominated representative. |

Employer Discretions Policy Formulate, publish and update (as necessary) in relation to all areas where the employer may exercise a discretion within the LGPS Regulations. A copy of the Policy must be provided to the Fund. | Provide a copy to the Fund within 30 working days of the policy being agreed Failure to provide the Fund with a copy of your policies could impact on the release/payment of individuals’ benefits.

|

Task/Function | Performance Target |

Enquiries & Data queries From the Fund

|

Respond to the Fund/administrators within 10 working days from receipt of enquiry.

|

Contributions – Employer & Employee Paid monthly to the Fund and to provide schedule of payments in the correct format stipulated by the Fund. |

Cleared funds to be received by/on 19th calendar day of the month following the deduction.

Failure to provide the Fund/Administrators with a schedule of contributions including additional pension payments – added years, ARCs, APCs, and AVCs - by the target date, and/or not in the correct format stipulated by the Fund, could result in additional administration costs being levied against you.

|

IMPORTANT NOTE

Late payment of pension contributions by Scheme employers is a serious offence and the Pensions Regulator or the Pensions Ombudsman has significant powers of sanction.

Scheme managers must report payment failures which are likely to be of material significance to the Pensions Regulator within a reasonable period, in the case of employee contributions; and as soon as reasonably practicable in the case of employer contributions

The Pensions Regulator can impose fines of up to £50,000 for each instance of persistent offence. Recent changes to the Pensions Act have made it easier to prosecute employers for late payment of contributions.

Any fines imposed on the Fund by the Regulator, which is deemed to be the fault of an Employer, will be passed on to that Employer

| |

Changes to employer contribution rates (as instructed by the Fund)

Note - Employer contributions are expressed as a percentage of pensionable pay, and are payable at such rate(s) as may be advised by London Borough of Hackney Pension Fund following the completion of each triennial actuarial valuation of the pension fund, or otherwise.

|

At date specified on the actuarial advice received by the Fund. |

Task/Function | Performance Target |

Year end Reports Required by the Fund in the format stipulated to your nominated representative in March each year.

|

Provide to the Administrators by 30 April following the year end. |

Additional Data & Information Requests May be requested by the Fund for the production of the annual benefit statements in each year

|

Respond to the Fund/administrators within 10 working days of receipt of the request from the Fund |

Data Errors Following validation by the Fund, errors may be found in the contribution and/or year end information - corrective action may need to be taken promptly.

|

Respond fully to the Fund/administrators within 10 working days of receipt of the request from the Fund |

Auto-enrolment – monthly assessment Ensure that any staff who are not already scheme members are assessed according to their age and earnings.

|

Assessment to be made according to pay periods (e.g. staff paid monthly should be monitored on a monthly basis) |

Auto-enrolment within statutory deadlines Ensure that any staff who are not scheme members and become an Eligible Jobholder and none of the statutory exceptions apply, are enrolled into the LGPS.

|

With effect from the employee’s auto-enrolment date

Employers must provide the Fund/Administrators with their monthly AE reports 1 month following the month of enrolment |

Auto-enrolment communications Where employers are providing their own Automatic Enrolment communications, they must ensure that any staff affected by AE (including new starters) are provided with the necessary AE information within statutory deadlines

|

Within 6 weeks of the date they become eligible for automatic enrolment |

Auto-enrolment communications – if provided by the Fund Where auto-enrolment (AE) communications are provided by the Fund |

Employers must provide the Fund with their monthly AE reports within 5 working days of your own payroll date |

Task/Function | Performance Target |

Contracting out services Involving a TUPE transfer of staff to another organisation.

|

Contact the Fund at the very beginning of the tender process so that important pension information can be provided for inclusion in the tender documentation.

|

Admission Agreements To be put in place for new employers admitted to the Fund following the when contracting out a service

|

Provide to new Employers within 3 months of joining the scheme |

Pension information Provided by the Fund is to be distributed to scheme members/potential scheme members

|

Provide to members within 15 working days of receipt of the information or on the member joining the scheme

|

Starter form and a Member Scheme Guide Provided to new/prospective scheme or refer them to the Fund website.

|

Provide to member within 5 working days of commencement of employment or change in contractual conditions. |

Additional fund payments In relation to early payment of benefits where a strain cost applies

|

Paid within 30 working days of receipt of invoice from the Fund. |

Additional administration costs Paid to the Fund associated with the poor performance of the scheme employer.

|

Paid within 30 working days of receipt of invoice from the Fund. |

Scheme Administration - Forms

This section details the employer responsibilities and tasks which relate to member benefits from the Scheme.

| Task/Function | Performance Target |

Contractual Enrolment To ensure that all employees are brought in to the Scheme from their employment start date.

Starter forms Complete a starter form for each new employee admitted to the pension scheme and ensure that the employee completes their element of the process.

More than one contract of employment Each contract must have its own starter form as each employment and pension membership must be maintained separately under the Regulations.

|

Provide Administrators with copy of the Starter form(s) within 15 working days of the employee’s employment start date |

Employee contribution rate Applied in accordance with the LGPS contribution bandings based on actual pensionable pay – including overtime/bonuses etc.

|

Immediately upon commencing scheme membership and in line with the employer’s policy and as a minimum in each April payroll thereafter.

|

Main Scheme or 50/50 Scheme contributions To apply the correct employee contribution rate according to actual pensionable pay of the member & in accordance to rates for main scheme or 50/50

To reassess employee contribution rate in line with employer’s policy on adjusting employee contribution rates and notify the employee of their change in rate.

|

Review as per employer’s own Employee Contribution Policy and effect a change in rate if necessary – ie a move from the main scheme to the 50/50 section of the scheme, or vis-versa

|

Election to join 50/50 section Member election form completed & signed – move member to 50/50 scheme & amend employee contributions only NOTE – Employer continues to pay FULL rate contributions

OR

Election to re-join Main scheme Member election form completed & signed – move member to main scheme & amend employee contributions only

|

Reduce employee contributions the month following month of election, or such later date specified by the scheme member.

Provide Administrators with copy of Election to join the 50/50 section form within 1 month following month of election

Increase employee contributions the month following month of election, or such later date specified by the scheme member.

Provide Administrators with copy of Re-join Main Scheme Election form within 1 month following month of election

|

Task/Function | Performance Target |

Commencing Additional Pension Contributions - APC After receipt of the completed & signed form from the member, commence deduction or amend such deductions, as appropriate.

|

Month following election to pay contributions or notification received from the Fund

Provide Administrators with copy of the APC agreement form within 1 month of first contribution paid.

|

Ceasing deduction of :- Added Years Contracts Additional Regular Contributions - ARC Additional Pension Contributions - APC After receipt of the completed and signed forms from the member

|

Immediately following receipt of election form from scheme member

Provide Administrators with copy of cessation form/notification within 1 month of ceased payments

|

AVC – Additional Voluntary Contributions Arrange for the deduction of AVCs via your payroll provider and the payment over of contributions to the approved AVC provider(s)

|

Commence deduction of AVCs in month of the member’s election – provide Administrators with copy of AVC member form in the month of member’s election

Pay over contributions to the AVC provider(s) on/by the 19th of the month the deduction was made in |

IMPORTANT NOTE

Monthly AVC deductions should be paid directly to the AVC provider (Prudential) as soon as the payrolls are processed. A schedule must be sent with the payment, giving details of all contributions paid over to Prudential which must reach Prudential by the 19th day of the month following the month they were deducted.

Scheme managers must report payment failures which are likely to be of material significance to the Pensions Regulator within a reasonable period, in the case of employee contributions; and as soon as reasonably practicable in the case of employer contributions

Failure to do so is in breach of legislation and may be reported to the Pensions Regulator. Any fines imposed on the Fund by the Regulator, which is deemed to be the fault of an Employer, will be passed on to that Employer

| |

Opt outs Member to complete the appropriate form – employer to provide copy of the form to the Fund

|

To cease contributions the month following month of election, or such later date specified by the scheme member.

Provide copy of Opt out form to the Administrators within 1 month following month of election to opt out

|

Task/Function | Performance Target |

Opt outs – within 3 months of start date Refund employee contributions via your own payroll - where the member has opted out of the Scheme within 3 months of joining.

|

Refund to be made in the month following the month of election to opt out.

Refunds are to be included in the monthly contribution data to the Administrators

|

Contractual changes to conditions of service: · contractual hours · actual pay – including overtime · remuneration changes due to promotion or re-grade · honorariums

|

Provide copy of Change of Details form the Administrators within 20 working days of change. |

Changes in member’s personal circumstances: · marital or civil partnership status · change of name · national insurance number

|

Immediately inform the Administrators following notification by the scheme member of a change in circumstances |

Assume Pensionable Pay – APP Periods of reduced pay or nil pay as a result of: · sickness · injury · or relevant child related leave, includes – ordinary maternity, paternity or adoption leave; paid shared parental leave; any additional maternity or adoption leave

Employer must apply Assumed Pensionable Pay (APP) for pension purposes.

The employer contributions must be deducted against the amount of APP and employee contributions against any actual pay they receive.

|

Employers must notify the Administrators of the date the reduction is effective from for sickness or injury OR the date from which the relevant child related leave began.

Provide the appropriate absence form to the Administrators within 20 working days of effective date. |

Task/Function | Performance Target |

Periods of reduced pay or nil pay as a result of: · unpaid additional maternity, paternity or adoption leave · unpaid shared parental leave

taken at the end of the relevant child related leave. |

This is treated as unpaid leave for pension purposes - Assumed Pensionable Pay (APP) does NOT apply.

Provide the appropriate absence form to the Administrators within 20 working days of effective date

|

Periods of reduced pay or nil pay as a result of: · authorised/unauthorised unpaid leave of absence (sabbatical etc) · industrial action

|

This is treated as unpaid leave for pension purposes - Assumed Pensionable Pay (APP) does NOT apply.

Provide the appropriate absence form to the Administrators within 20 working days of effective date

|

Leavers – leaving your employment The leaver form must include an accurate assessment of their final pay.

|

Provide the Administrators with a completed leaver form within 15 working days of month end of leaving.

Revised pay details can be submitted to the Administrators on an amended leaver form if they differ from the initial notification

|

Retiring – normal retirement from your employment The leaver form must including an accurate assessment of their final pay.

You must also provide the authorisation form, stating the reason for retirement, signed by the employer as agreement to meet any associated costs with the retirement.

|

Provide the leaver form to the Administrators within 15 working days before the member retires

Revised pay details can be submitted to the Administrators on an amended leaver form if they differ from the initial notification |

Death of a scheme member

OR

Member is suffering from a potentially terminal illness .

|

Notify the Administrators who will then ensure next of kin details are held and any benefits due are paid in accordance with the members’ wishes, if appropriate

As soon as practicable, but within 5 working days of members death |

| Task/Function | Performance Target |

Ill Health Retirement applications Employer to appoint an independent registered medical practitioner (IRMP) qualified in occupational health medicine, in order to consider all ill health retirement applications

|

Notify the Administrators within 1month of commencing participation in the scheme, or date of resignation of existing medical adviser |

Ill Health Retirement decisions The Employer must determine, based on medical opinion from your IRMP (and assistance from the Administering Authority, if required), whether ill health retirement benefits are to be awarded and to determine which tier of benefits are to be awarded e.g. Tier 1, 2 or 3.

|

To make the decision within 1 month of receipt of the IRMP report

Provide the Administrators with the ill health retirement declaration form & completed leaver form with 5 working days of the employers final determination and agreed last day of service for the member

Refer to page 39 – ill health retirements & tier 3 awards – if you require any assistance

|

Ill Health Retirements – Tier 3 awards Employers must keep a record of all Tier 3 ill health retirements, & undertake a review once the pension has been in payment for 18mths to assess if the former employee is gainfully employed & payments are to cease and to arrange subsequent appointments with the IRMP to assess whether an increase in benefits is applicable.

|

Notify the Administrators within 5 working days of the review being completed in accordance with the LGPS regulations, by providing all necessary paperwork for the Administrators to either continue or cease payments, or to increase the level of benefits to be paid.

Refer to page 39 – ill health retirements & tier 3 awards – if you require any assistance |

Important Note:

The Fund will begin introducing the use of Employer Service (ESS) for you to submit your monthly data to Equiniti. ESS will be live from October 2020, and you will be expected to be using this portal alongside the existing secure portal Sharefile during the trial period from October to end of March 2021.

ESS will become mandatory from 1 April 2021 following the initial trial period, and some of the above information can, and will be provided on your monthly data submissions through ESS, and as such not all of the administration forms will be used

Once ESS is mandatory, this Strategy will be updated to reflect the changes in data collection and the additional administration costs for those employers either not using ESS, or not using ESS correctly. A revised PAS will be issued in September 2021.

MONITORING PERFORMANCE AND COMPLIANCE

Ensuring compliance with the Scheme regulations and this Administration Strategy is the responsibility of the Fund and Scheme Employers. We will work closely with all Scheme employers to ensure compliance with all statutory requirements, whether they are specifically referenced in the LGPS Regulations, in overriding legislation or in this Administration Strategy.

This section describes the ways in which performance and compliance will be monitored.

The Pension Board, the National Scheme Advisory Board & the Pensions Regulator (tPR)

The Public Service Pensions Act 2013 established the requirement for local Pension Boards in the LGPS with responsibility for assisting the Administering Authority in relation to the following:

- Securing compliance with the scheme regulations

- Ensuring the effective and efficient governance and administration of the scheme

- Securing compliance with the requirements imposed in relation to the LGPS by the Pensions Regulator; and

- Such other matters as the LGPS regulations may specify.

As a result the Local Pension Board of the London Borough of Hackney Pension Fund was established from 1 April 2015. A key aim of the Pension Board is to raise the standard of management and administration of public service pension schemes and to achieve more effective representation of employer and employee interests in that process.

In addition, the Pensions Regulator's remit was extended to include the public sector, and a national Scheme Advisory Board was created. The Administering Authority and scheme employers are expected to fully comply with any guidance produced by the Scheme Advisory Board and the Pensions Regulator. Any recommendations made by any of these entities will be considered by the Administering Authority, and where appropriate duly implemented (following discussions with employers where necessary).

Audit

The Fund is subject to an annual external audit of the accounts and, by extension the processes employed in calculating the figures for the accounts, by KPMG. The key findings of their work are presented to the Pensions Committee in an Annual Governance Report and the Fund is set an action plan of recommendations to implement.

In addition the Fund is subject to internal audits by the Council of its processes and internal controls. Any subsequent recommendations made are considered by the Fund and where appropriate duly implemented (following discussions with scheme employers where necessary).

Performance monitoring

The Fund monitors Equiniti’s performance against the agreed contract and Service Level Agreements (SLAs). Monthly Service Review Meetings (SRM) are held were work received/completed and SLAs are discussed and Equiniti are asked to explain any variations from the SLAs and Key Performance Indicators (KPIs).

Measuring the Fund against the administration objectives

| Objectives | Measurements |

Deliver an efficient, quality and value for money service to its scheme employers and scheme members |

Service standards achieved in 95% of cases (100% for legal requirements)

Customer Satisfaction Surveys with scheme employers and scheme members achieving 95% of scores in positive responses in these areas

Positive scheme employer feedback with minimal or no employer complaints

Positive scheme member feedback with minimal or no member complaints

|

Improving the delivery of services, enhanced security and interaction with scheme employers, by greater use of technology and partnership working.

|

Use of Employer Self Service (ESS) as a default, (100% of employers using the data portal), unless valid reasons not to do so (and have been agreed by the Fund) Positive scheme employer feedback with minimal or no employer complaints

No breaches of data security protocols

|

Ensure payment of accurate benefits and collect the correct contributions from the right people in a timely manner

|

Positive results in internal and external audits and other means of oversight/scrutiny.

Performance target achieved for collection of contributions by 19th day of the month following the deduction

Minimal issues against the Fund identified by Internal Dispute Resolution Procedures and complaints

|

Ensure the Fund’s employers are aware of and understand their role and responsibilities under the LGPS regulations and in the delivery of the administration function |

Customer Satisfaction Surveys with scheme employers achieving 95% of scores in positive responses in these areas

Issues included in formal improvement notices issued to scheme employers resolved in accordance with plan

Notify scheme employers of changes to the scheme rules within 2 months of change

Offer/organise training sessions for new scheme employers and relevant new staff in scheme employers within 2 weeks of new employer/staff starting

Organise training for employers where unsatisfactory performance and escalate within 1 month if not attended training or improvements not evident

Employer responsibilities in relation to administration are regularly communicated to employers

|

Maintain accurate records and communicate all information and data accurately, and in a timely and secure manner |

No breaches of data security protocols

Annual data checks (including ongoing reconciliations) resulting in few issues that are all resolved within 2 months

Data improvement plan in place with ongoing evidence of delivered agreed improvements

Positive results in audit and other means of oversight/scrutiny

|

Set out clear roles and responsibilities for the Fund and Equiniti and work together to provide a seamless service to Scheme employers and scheme members |

Monthly monitoring of Equiniti where Fund asks them to explain variations from agreed Service Level Agreement targets

The Fund specifies clear service standards with Equiniti

|

Continuously review and improve the

services provided |

Achieve continual improvement in member engagement with our online tools

Monitoring of the performance standards used to inform the service going forward

Use feedback from scheme employers on the service to develop plans

Fund work with Equiniti on programme of continuous improvement to the service

|

Key Risks

The key risks to the delivery of this Strategy are outlined below. Fund officers will work with the Pensions Committee and Pension Board in monitoring these and other key risks and consider how to respond to them.

- Significant external factors, such as national change, impacting on workload

- Lack or reduction of skilled resources due to difficulty retaining and recruiting staff members

- Inadequate performance of Equiniti against service standards

- Increase in the number of employing bodies causes strain on day to day delivery

- Incorrect calculation of members' benefits, resulting in inaccurate costs

- Employer’s failure to provide accurate and timely information resulting in incomplete and inaccurate records. This leads to incorrect valuation results and incorrect benefit payment

- Failure to administer the scheme in line with regulations. This may relate to delays in enhancement to software or regulation guidance

- Failure to maintain records adequately resulting in inaccurate data

- Unable to deliver an efficient service to pension members due to system unavailability or failure.

Feedback from employers

Employers who wish to provide feedback on the performance of the Fund against the standards in this Administration Strategy should e-mail comments to the following address: pensions@hackney.gov.uk . This will be acknowledged within 5 working days and an investigation of the matter will then be undertaken. Following the investigation a response will be provided to the scheme employer within 15 working days of the initial acknowledgment.

Annual report on the strategy

The Scheme regulations require the Fund to undertake a formal review of performance against the Administration Strategy on an annual basis. This report details the performance of the pension administrators and the Fund’s Employers. It is presented to Pensions Committee, Pensions Board and is included within the Pension Fund Annual Report and Accounts.

ROLE OF THE PENSIONS REGULATOR (tPR)

Background

Section 17 and Schedule 4 of the Public Service Pensions Act 2013 extended the role of the Pensions Regulator to include public sector pension schemes including the Local Government Pension Scheme (LGPS) from 1 April 2015. With regard to the LGPS, the Pensions Regulator now has responsibilities in relation to governance and particularly administration.

Schedule 4 of the Public Service Pensions Act 2013 requires the Pensions Regulator to issue a Code of Practice or Codes of Practice in respect of certain specified matters. In response to this requirement, the Pensions Regulator Code of Practice No 14 “Governance and administration of public service pension schemes” which came into effect from 1 April 2015.

This Code of Practice is applicable both to the Pension Fund and the individual Employers within the Fund.

Code of Practice No 14

Governance and Administration of Public Service Pension Schemes

Code of Practice No 14 covers the following:-

Governing your scheme

Knowledge and understanding required by pension board members

Conflicts of interest and representation

Publishing information about schemes

Managing risks

Internal Controls

Administration

Scheme record-keeping

Maintaining contributions

Providing information to members

Resolving issues

Internal dispute resolution

Reporting breaches of the law

It is crucial that all Employers within the London Borough of Hackney Pension Fund are aware of, and comply with, the legal requirements and standards covered in the Code.

Failures by an Employer to fulfil legal requirements and follow the expected standards within the Code may result in that Employer (rather than the Pension Fund) being subject to legal enforcement action by the Pensions Regulator.

Sections that have particular relevance for Employers in the Fund are Administration and Resolving Issues

Administration

Scheme record-keeping

Key points

- The Scheme should work with employers to ensure they understand what information they’re required to provide and when they need to do this.

- The Scheme should work with participating employers to seek to ensure they understand the key events and information they need to provide, and have processes in place to provide timely and accurate data.

- If an employer fails to provide the required information (meaning that they and/or the Scheme Manager may not be complying with legal requirements), the Scheme should consider whether to report the breach to the Pensions Regulator (tPR).

Schemes require participating employers to provide them with timely and accurate data in order for the scheme manager to be able to fulfil their legal obligations. Schemes should seek to ensure that employers understand the main events which require information about members to be passed from the employer to the scheme and/or another employer, such as when an employee:

- joins or leaves the scheme

- changes their rate of contributions

- changes their name, address or salary

- changes their member status, and

- transfers employment between scheme employers.

If any Employer fails persistently to act according to the procedures set out in this Pension Administration Strategy, meaning that they and/or the Fund may not be complying with legal requirements, the Fund will assess whether there has been a relevant breach and take action as necessary to report breaches of the law to the Regulator under Section 70 of the Pensions Act 2004.

Maintaining contributions

Reporting payment failures

The Scheme must report payment failures that are likely to be of 'material significance' to the Pensions Regulator (tPR) as soon as possible – usually within 10 working days.

A late payment is likely to be of material significance where it was caused by:

- the employer not being willing or able to pay contributions

- possible dishonesty or misuse of assets or contributions

- fraudulent evasion of the duty to pay contributions

- the employer having inadequate procedures or systems in place to ensure the correct and timely payment of contributions due, for example where there are repetitive and regular payment failures,

- contributions having been outstanding for more than 90 days

If any Employer has 3 repetitive or regular payment failures in any one financial year, the Fund will deem this as being of 'material significance' and in-line with its legal responsibilities, report this to the Pensions Regulator (tPR), immediately following the third failure. The Employer may then be subject to legal enforcement action by the Pensions Regulator.

Resolving issues

Internal dispute resolution (IDRP)

Where a person with an interest in the scheme isn’t satisfied with any matter relating to the scheme, they have the right to ask for that matter to be reviewed.

A person has an interest in the scheme if they:

- are a member or surviving non-dependant beneficiary of a deceased member of the scheme

- are a widow, widower, surviving civil partner or surviving dependant of a deceased member of the scheme

- are a prospective member of the scheme

- have ceased to be a member, beneficiary or prospective member or

- claim to be in one of the categories mentioned above and the dispute relates to whether they are such a person.

The Fund has a clear internal disputes resolution procedure (IDRP) set out for members of the LGPS which can be found on the Pension Fund’s website: www.hackneypension.co.uk

All Scheme employers are required to nominate a Stage 1 Adjudicator to deal with disputes at Stage 1 of the process. Scheme employers are asked to supply the details of their Stage 1 Adjudicator as part of their discretionary policy statement and should advise the Fund immediately of changes made in this regard.

Where a Scheme employer is in dispute with a decision or action taken by the Fund, the Fund will in the first instance attempt to resolve the matter internally and may seek an independent senior mediator from within London Borough of Hackney as the Administering Authority to make a final determination. Should this prove to be unsuccessful, a suitable, mutually agreeable and independent third party shall be appointed to determine the outcome of the matter.

POLICY ON THE RECOVERY OF ADDITIONAL ADMINISTRATION COSTS FROM EMPLOYERS

The Scheme regulations provide pension funds with the ability to recover from a scheme employer any additional costs associated with the administration of the Scheme incurred as a result of the unsatisfactory level of performance of that Scheme Employer.

Where a fund wishes to recover any such additional costs they must give written notice stating:

- The reasons in their opinion that the Scheme Employer’s unsatisfactory level of performance contributed to the additional cost

- The amount of the additional cost incurred

- The basis on how the additional cost was calculated

- The provisions of the Administration Strategy relevant to the decision to give notice.

Circumstances where costs might be recovered

It is the policy of the Fund to recover additional costs incurred in the administration of the Scheme as a direct result of the unsatisfactory level of performance of any scheme employer (including the Council) or third party service provider. This includes the payment of fees levied against the scheme employer.

The circumstances where such additional costs will be recovered from the scheme employer are:

- persistent failure to provide relevant information to the Fund, scheme member or other interested party in accordance with specified performance targets in this Administration Strategy (either as a result of timeliness of delivery or accuracy/quality of information)

- failure to pass relevant information to the scheme member or potential members, either due to poor quality of information or not meeting the agreed timescales outlined in the performance targets in this Administration Strategy

- failure to deduct and pay over correct employee and employer contributions to the Fund within the stated timescales

- instances where the performance of the scheme employer results in fines being levied against the Fund by the Pension Regulator (tPR), Pensions Ombudsman or other regulatory body.

For the avoidance of doubt, “accuracy/quality” in this Strategy is defined as when we have received a completed form, or transfer of information, with no gaps in mandatory areas and with no information which is either contradictory or which we need to query.

Approach to be taken by the Fund

The Fund will seek, at the earliest opportunity, to work closely with scheme employers in identifying any areas of unsatisfactory performance, provide the necessary training and put in place appropriate processes to improve the level of service delivery in the future. Consideration for seeking additional administration costs where persistent failure occurs and no improvement is demonstrated by a scheme employer would be seen as a failure and will only be taken once the steps described below are taken to resolve the situation:

1. Write to the scheme employer, setting out area(s) of concern and offer training.

2. If no improvement is seen within one month of the training or no response is received to the initial letter, the scheme employer will be asked to attend a meeting with representatives of the Fund to discuss area(s) of concern and to agree an action plan to address them. Where appropriate, the originating employer will be informed and expected to work with the Fund to resolve the issues.

3. If no improvement is seen within one month or a scheme employer is unwilling to attend a meeting to resolve the issue, the Fund will issue a formal written notice, setting out the area(s) of concern that have been identified, the steps taken to resolve those area(s) and notice that the additional costs will now be reclaimed.

4. An invoice will then be issued to the scheme employer clearly setting out the calculations of any loss resulting to the Fund, or additional cost, taking account of time and resources in resolving the specific area(s) of unsatisfactory performance, in accordance with the fee scale set out in this document.

5. An annual report will be presented to the Pensions Committee meeting detailing any fees levied against scheme employers and outstanding payments.

Fees for additional administration

The table below sets out the fees which the Fund will levy on a scheme employer whose performance falls short of the standards set out in this document. Each task is referenced to the Employer Responsibilities section. Charging is a last resort and the approach outlined above will be followed before a fee is levied.

| Employer Responsibility | Additional Administration Charge |

Monthly Contributions Payment

Late payment of employee and employer contributions to the administrators by the 19th calendar day of month following deduction (must be cleared funds by/on 19th of the month)

|

£65 plus interest*, calculated on a daily basis until contributions received.

*Interest will be charged in accordance with regulation 44 of the LGPS Administration regulations, which states interest should be charged at Bank of England Base Rate plus 1%.

|

Employer Responsibility | Additional Administration Charge |

Monthly Contributions Schedule (HK221)

Non-provision of the correct schedule of payments and/or not in the format stipulated by the Fund, accompanying the contributions by the 19th calendar day of month following deduction

|

£65 per occasion |

NOTE - Any fines imposed on the Fund by the Pensions Regulator, in relation to employer, employee and AVC contributions which is deemed to be the fault of the Employer, will be passed on to that Employer

|

Re-charge amount to be paid within 30 days of receipt |

Change Notifications

failure to notify the administrators of any change to a members - working hours - leave of absence with permission (maternity, paternity, career break) or - leave of absence without permission (strike, absent without permission) - within 20 days of the change in circumstance

|

£65 per form, per occasion |

Year End Data

Failure to provide year end data by 30th April following the year end or the non-provision of year end information or the accuracy/quality of the year end data is poor requiring additional data cleansing

For the avoidance of doubt “accuracy/quality” in this Strategy is defined as when we have received a completed form or transfer of information with no gaps in mandatory areas and with no information which is either contradictory or which we need to query

|

Late receipt - initial fee of £300

then a fee of £150 for every month the information remains outstanding

Quality/format of data – fee of £150 should data provided not be in the correct format and/or the quality is poor |

Employer Responsibility | Additional Administration Charge |

New Starter(s) Failure to notify the administrators of new starter(s) and the late or non-provision of starter form(s) – within 15 days of employee joining the scheme

|

Initial fee of £65 per form then a fee of £35 per form for each month the form(s) remains outstanding |

Automatic Enrolment (AE)

Failure to provide the administrators full details of staff affected by Automatic Enrolment on a monthly basis - within 6 weeks of the date they become eligible for automatic enrolment

NOTE - Any fines imposed on the Fund by the Pensions Regulator due to failure to provided information for Auto enrolment process, which is deemed to be the fault of the Employer, will be passed on to that Employer

|

Initial fee of £100

then a fee of £50 for every month the information remains outstanding

Re-charge amount to be paid within 30 days of receipt |

Leaver(s)

Failure to notify the administrators of any leaver(s) and the late or non-provision of leaver form(s) including an accurate assessment of final pay – within 15 days of employee leaving the scheme or employment

|

Initial fee of £65 per form

then a fee of £35 per form for each month the form(s) remains outstanding |

Retirees Failure to notify the administrators when a scheme member is due to retire 15 working days before the retirement date - including an accurate assessment of final pay and authorisation of reason for retirement.

|

Initial fee of £65 per form then a fee of £35 per form for each month the form(s) remains outstanding

|

Late payment of pension benefits As a result of the employers failure to notify the administrators of a scheme members retirement & not providing the correct paperwork, interest becomes payable on any lump sum paid. The administrators will recharge the total amount of interest paid back to the employer |

Calculation will be provided – payment due is as invoiced within 30 days of receipt of invoice |

Important Note:

The Fund will begin introducing the use of Employer Service (ESS) for you to submit your monthly data to Equiniti. ESS will be live from October 2020, and you will be expected to be using this portal alongside the existing secure portal Sharefile during the trial period from October to end of March 2021.

ESS will become mandatory from 1 April 2021 following the initial trial period, and some of the above information can, and will be provided on your monthly data submissions through ESS, and as such not all of the administration forms will be used

Once ESS is mandatory, this Strategy will be updated to reflect the changes in data collection and the additional administration costs for those employers either not using ESS, or not using ESS correctly. A revised PAS will be issued in September 2021.

EMPLOYER CONTRIBUTION RATES / ADDITIONAL EMPLOYER ASSISTANCE & ASSOCIATED COSTS

Employers Contribution Rates

Employers' contribution rates are not fixed. Employers are required to pay whatever is necessary to ensure that the portion of the fund relating to their organisation is sufficient to meet its liabilities.

The London Borough of Hackney has an actuarial valuation undertaken every 3 years by the Fund's actuary. The actuary balances the fund’s assets and liabilities in respect of each employer, and assesses the appropriate contribution rate for each employer to be applied for the subsequent 3 years.

Additional Employer Assistance & Associated Costs

The cost of running the London Borough of Hackney Pension Fund is charged directly to the Fund, and the actuary takes these costs into account in assessing the employers' contribution rates.

The following tasks will be undertaken by the Administering Authority, but are recharged back to the letting department/directorate or school:-

| Task/Function | Description & Associated cost |

FRS102 – for company Report & Accounts | Provision of data required for FRS102 calculations to the Actuary, plus any chargeable Actuary time

Cost – standard administration charge £100 Plus as invoiced from the Actuary + any chargeable Actuary time as invoiced

|

Admission Agreements – when contracting out services e.g .cleaning, catering, security provision – involving TUPE of existing staff | Setting up and amendment of admission agreements for Contractors/new Employers admitted to the Fund

Cost – standard administration charge of £100 plus as invoiced from the Actuary/Legal + any chargeable Actuary/Legal time as invoiced, if required

|

Cessation Valuations (upon service contract ending)

Interim Valuations (either during or prior to the service contract ceasing)

| Provision of data required for interim and/provision of data required for interim and/or cessation valuations

Cost – as invoiced from the Actuary + any chargeable Actuary time as invoiced

|

Academy Conversions – schools converting to Academy status | Any work related to this requiring input from the Administering Authority

Cost – as invoiced from the Actuary + any chargeable Actuary time as invoiced

|

Legal Work & non-standard actuarial work | Any work in relation to this requiring input from the Administering Authority – e.g. contract review on outsourcing, employer policies, TUPE & future pension provision etc.

Cost – as invoiced from the Actuary/Legal + any chargeable Actuary/Legal time as invoiced

|

If an employer wishes the *London Borough of Hackney to carry out work not attributable to pension’s administration they will be charged directly for the cost of that work.

The following functions have been designated Employer Functions – this means that they are outside of the normal scope of pension administration responsibilities for the Fund, but the Administering Authority is willing to assist employers with these services.

They will be subject to a charge depending on the level of work required and whether external suppliers have to be engaged such as the Fund’s Actuary, Occupational Health, etc.

| Task/Function | Description & Associated cost |

*Redundancy & Severance calculations (excluding/including pension calculation)

*Efficiency Retirements

*Flexible Retirements

| Information, guidance, calculations and the preparation of associated paperwork for employee signature and payroll instructions

Cost – 1 estimate per employee, per rolling 12 month period is provided free of charge.

Subsequent requests from the employer due to a change of circumstance (e.g. last day of service, change of earnings) will be charged at £50 per case

|

Ill health retirements & Tier 3 awards.

| Monitor and review tier 3 ill health awards to cessation, liaise with Occupational Health Services, and provide support at the IHRP meetings to determine cessation of benefits or a potential uplift in benefits

Cost – as charged by the Occupational Health Service used for each case

|

Injury payments | Calculation and payment of injury awards

Cost – standard administration charge £100 plus any cost as invoiced from the Actuary + any chargeable Actuary time as invoiced

|

* the Administering Authority’s (LB Hackney) Pensions Team, upon receipt of accurate information on the appropriate estimate request form in relation to an active member, or employee not in the LGPS, retiring due to age, redundancy, efficiency or flexible retirement, can provide 1 free estimate per member/employee, per 12 month rolling period.

Estimates are normally returned to the requesting employer within 20-30 working days of the receipt of the request – timeframe is dependent on checking employee employment/pension records, complexity of each case and the number of requests received at any one time

SERVICE AND COMMUNICATION IMPROVEMENT PLANNING

As set out earlier in this Administration Strategy, the Fund’s objective in relation to administration is to deliver an efficient, quality and value for money service to its scheme employers and scheme members. This can only be achieved through continuously reviewing and improving the service. Communication between the Fund and scheme employers is key to providing the service and is therefore an important aspect of service improvement planning.

Equiniti and the administering authority’s in-house pension team work together on a programme of continuous improvement to the service.

The monitoring of the performance standards set out in this document will inform the programme going forward and feedback from scheme employers on the service and the way in which the Fund communicates is welcomed in developing plans. Feedback should be e-mailed to: pensions@hackney.gov.uk.

The Fund will take responsibility for improving the service and determining the balance between implementing service improvements and the goal of providing a value for money service for the Fund.

Employers will be informed of any changes to the service provision which affect the way they interact with the Fund.

Important Note:

The Fund will begin introducing the use of Employer Service (ESS) for you to submit your monthly data to Equiniti. ESS will be live from October 2020, and you will be expected to be using this portal alongside the existing secure portal Sharefile during the trial period from October to end of March 2021.

ESS will become mandatory from 1 April 2021 following the initial trial period, and some of the above information can, and will be provided on your monthly data submissions through ESS, and as such not all of the administration forms will be used

Once ESS is mandatory, this Strategy will be updated to reflect the changes in data collection and the additional administration costs for those employers either not using ESS, or not using ESS correctly. A revised PAS will be issued in September 2021.

CONSULTATION AND REVIEW PROCESS

In preparing this Administration Strategy the Fund has consulted with all the scheme employers with active contributors in the Fund. The Strategy will be reviewed every 3 years, or more frequently if there are changes to the Scheme regulations or requirements.

All scheme employers will be consulted before any changes are made to this document.

The latest version of this document can be accessed from the Fund website www.hackneypension.co.uk

LOCAL GOVERNMENT PENSION SCHEME REGULATIONS 2013

The Regulations in relation to the Pension Administration Strategy are contained in the Local Government Pension Scheme Regulations 2013, and are set out below:

Pension administration strategy

59.(1) An administering authority may prepare a written statement of the authority’s policies in relation to such of the matters mentioned in paragraph (2) as it considers appropriate (“its pension administration strategy”) and, where it does so, paragraphs (3) to (7) apply.

(2) The matters are —

(a)procedures for liaison and communication with Scheme employers in relation to which it is the administering authority (“its Scheme employers”);

b)the establishment of levels of performance which the administering authority and its Scheme employers are expected to achieve in carrying out their Scheme functions by—

(i)the setting of performance targets,

(ii)the making of agreements about levels of performance and associated matters, or

(iii)such other means as the administering authority considers appropriate;

(c)procedures which aim to secure that the administering authority and its Scheme employers comply with statutory requirements in respect of those functions and with any agreement about levels of performance;

(d)procedures for improving the communication by the administering authority and its Scheme employers to each other of information relating to those functions;

(e)the circumstances in which the administering authority may consider giving written notice to any of its Scheme employers under regulation 70 (additional costs arising from Scheme employer’s level of performance) on account of that employer’s unsatisfactory performance in carrying out its Scheme functions when measured against levels of performance established under sub-paragraph (b);

(f)the publication by the administering authority of annual reports dealing with—

(i)the extent to which that authority and its Scheme employers have achieved the levels of performance established under sub-paragraph (b), and

(ii)such other matters arising from its pension administration strategy as it considers appropriate; and

(g)such other matters as appear to the administering authority after consulting its Scheme employers and such other persons as it considers appropriate, to be suitable for inclusion in that strategy.

(3) An administering authority must—

(a)keep its pension administration strategy under review; and

(b)make such revisions as are appropriate following a material change in its policies in relation to any of the matters contained in the strategy.

(4) In preparing or reviewing and making revisions to its pension administration strategy, an administering authority must consult its Scheme employers and such other persons as it considers appropriate.

(5) An administering authority must publish—

(a)its pension administration strategy; and

(b)where revisions are made to it, the strategy as revised.

(6) Where an administering authority publishes its pension administration strategy, or that strategy as revised, it must send a copy of it to each of its Scheme employers and to the Secretary of State as soon as is reasonably practicable.

(7) An administering authority and its Scheme employers must have regard to the pension administration strategy when carrying out their functions under these Regulations.

(8) In this regulation references to the functions of an administering authority include, where applicable, its functions as a Scheme employer

Payment by Scheme employers to administering authorities

69.—(1) Every Scheme employer must pay to the appropriate administering authority on or before such dates falling at intervals of not more than 12 months as the appropriate administering authority may determine—

(a) all amounts received from time to time from employees under regulations 9 to 14 and 16(contributions);

(b) any charge payable under regulation 68 (employer’s further payments) of which it has been notified by the administering authority during the interval;

(c) a contribution towards the cost of the administration of the fund; and

(d) any amount specified in a notice given in accordance with regulation 70 (additional costs arising from Scheme employer’s level of performance).

(2) But—

(a) a Scheme employer must pay the amounts mentioned in paragraph (1)(a) within the prescribed period referred to in section 49(8) of the Pensions Act 1995(41); and

(b) paragraph (1)(c) does not apply where the cost of the administration of the fund is paid out of the fund under regulation 4(5) of the Local Government Pensions Scheme (Management and Investment of Funds) Regulations 2009 (management of pension fund)(42).

(3) Every payment under paragraph (1)(a) must be accompanied by a statement showing—

(a) the total pensionable pay received by members during the period covered by the statement whilst regulations 9 (contributions) applied (including the assumed pensionable pay members were treated as receiving during that period),

(b) the total employee contributions deducted from the pensionable pay referred to in sub-paragraph (a),

(c) the total pensionable pay received by members during the period covered by the statement whilst regulation 10 applied (including the assumed pensionable pay members were treated as receiving during that period),

(d) the total employee contributions deducted from pensionable pay referred to in sub-paragraph (c),

(e) the total employer contributions in respect of the pensionable pay referred to in sub-paragraphs (a) and (c),

(f) the total additional pension contributions paid by members under regulation 16 (additional pension contributions) during the period covered by the statement, and

(g) the total additional pension contributions paid by the employer under regulation 16(additional pension contributions) during the period covered by the statement.